In Stealthx, you will got to know about What is Algorithmic Trading and Why it Matters in Modern Trading, So as we all know that , Financial markets trading has evolved over the years.Previously, traders were required to spend hours in front of the screens manually placing the trades and responding to the market changes.

Technology nowadays has transformed the trading process to be efficient, disciplined and data-driven.Algorithms trading is one of the largest transformations.Simply put, the automatic trading of computer programs that are based on a set of rules.

Trades are not done on emotions and guesswork but logic, data and strategy.This practice applies to forex, crypto, and stock markets in large quantities, and it is significantly involved in the functioning of modern trading.

What Exactly Is Algorithmic Trading?

This is a trading approach in which a computer program is used in making the trade decision, also referred to as algorithm.

The algorithms have certain rules including:

When to enter a trade

When to exit a trade

How much risk to take

What are the market conditions that should be avoided.

After the rules are put in place, the system does the trading automatically without any human intervention.

This eliminates the emotional trade and introduces sanity and order into the trade.

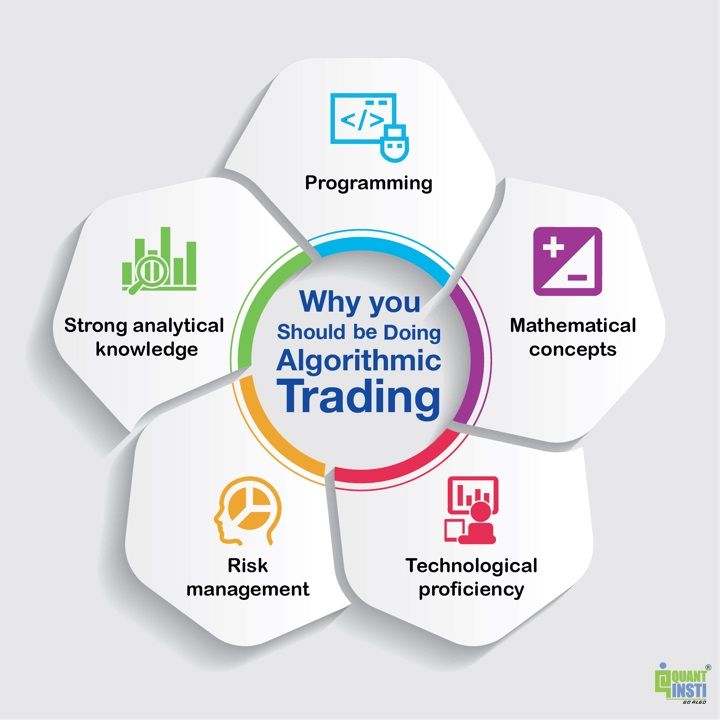

🧠 Why Algorithmic Trading Is Becoming So Important

Most traders cannot stick to their strategy and that is the reason why they fail.

The solution to this problem is algorithmic trading.

The Important reasons why algorithmic trading has become an important issue.

Trades are carried out onsite.

No emotional decisions

Identical rules were followed each time.

Works 24/7 without breaks

Better risk management

Due to these advantages, algorithmic trading is currently employed by banks, hedge funds, and retail traders in all parts of the globe.

📉 Manual Trading vs Algorithmic Trading

Understanding the difference helps explain why this matters.

Manual Trading

- Emotion-driven decisions

- Requires constant screen time

- Slower execution

- Higher chance of mistakes

Algorithmic Trading

- Rule-based execution

- Automated and disciplined

- Faster and accurate

- Controlled risk

This is why many traders move from manual trading to algorithmic trading once they understand its long-term benefits.

🌍 Why Algorithmic Trading Matters in Forex & Crypto Markets

Forex and crypto markets are extremely dynamic. Opportunities do not last long and prices vary in a matter of seconds.

The benefit of algorithmic trading is:

Observing markets at all times.

Reacting faster than humans

Dealing with various trades simultaneously

. Shunning unthoughtful actions.

In very liquid markets such as EUR/ USD, GBP/ USD, or other large crypto pairs, algorithmic trading establishes a system of order and consistency. Due to such advantages, banks, hedge funds, and retail traders in the global market now utilize algorithmic trading.

🛡️ Risk Management – The Real Strength of Algorithmic Trading

One of the biggest reasons matters is risk control.

Agorithmic Trading can :

- Use fixed lot sizes

- Automatically apply stop-loss

- Avoid overtrading

- Reduce drawdowns

This makes algorithmic trading suitable for beginners who want to trade safely and for professionals who want consistency.

🤖 How Algorithmic Trading Works in Real Life

The basic algo trading algorithm works like the following:

Market satisfies predetermined conditions.

Algorithm detects the setup

The trade is automatically put on.

Risk is managed by rules

Trade exits without emotion

Traders are kept in line with this process, as it assists them in being consistent with time.

📺 Explore more trading education on our YouTube channel–

📲 Join ourTelegram channel for updates, learning content, and insights

📲Join WhatsApp Community: [WhatsApp Community]

💼 Affiliate Opportunity: Content creators can join the StealthX Affiliate Program and earn up to 10% commission