“Why Bitcoin Outshines Every Asset: The Ultimate Game-Changer in 2025”

When people think of wealth creation, names like Amazon, Apple, Microsoft, Tesla, or even Gold usually come to mind. But if you look at the numbers, one asset has consistently crushed them all: Bitcoin.

Discussing the process of wealth creation in the past decade, there is one asset that evidently outperforms all others at this point, and it is Bitcoin.

Bitcoins have had a better investment performance in the last 10 years than stocks, gold, real estate and even the most aggressive hedge fund strategies.

Hype and luck are not unusual about Bitcoin. It is an amalgamation of scarcity, technology, worldwide adoption and evolving investor mindset. We will simplify everything in plain and open-minded words in this article so that anyone can understand the reasons why Bitcoin has taken control of all the largest components of wealth.

📈 Bitcoin’s Growth Story in Simple Words

In 2013, Bitcoin was trading under $100. It has reached the heights today which traditional investors never believed possible.

The performance of the Bitcoin investment has provided:

Stocks 10 Years Thousand percent returns.

Big fluctuations down and up — though better long-term returns.

🌏 Borderless global participation.

There is no stock index, commodity or currency that can match this growth within the same time span.

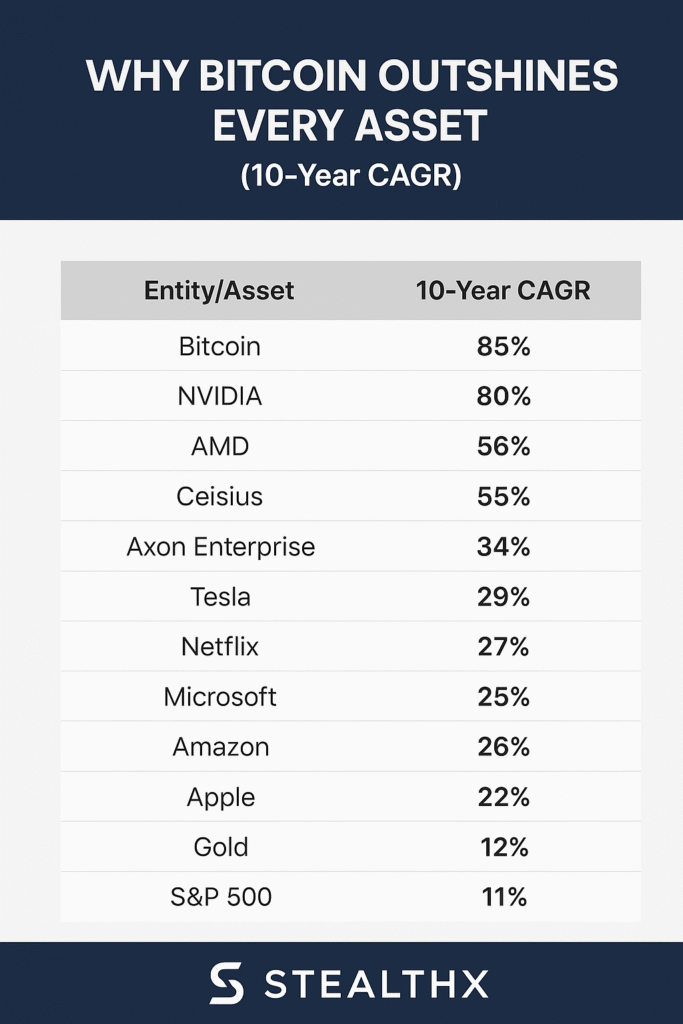

📊 10-Year CAGR Comparison

According to market data, here’s how different assets performed over the last decade:

- Bitcoin: 85% CAGR

- NVIDIA: 80% CAGR

- AMD: 56% CAGR

- Celsius: 55% CAGR

- Axon Enterprise: 37% CAGR

- Tesla: 34% CAGR

- Netflix: 29% CAGR

- Microsoft: 27% CAGR

- Amazon: 26% CAGR

- Apple: 22% CAGR

- Gold & S&P 500: 12% CAGR

👉 Even the strongest tech giants and traditional safe havens couldn’t match Bitcoin’s exponential growth.

🔑 Why This Matters for Traders & Investors

- High Growth Potential: Bitcoin’s performance shows how disruptive assets can reshape wealth creation.

- Diversification: Adding Bitcoin to a portfolio outperforms traditional stocks & commodities.

- Institutional Adoption: From hedge funds to Fortune 500 companies, crypto adoption is rising.

🌐 The StealthX Approach

At StealthX, we don’t just look at historical numbers — we leverage algorithmic trading strategies to capture opportunities in Bitcoin, Forex, and Crypto markets safely and consistently.

Here’s how we help traders:

✅ Algo-based trading bots to reduce human error

✅ Safe scripts tested on EUR/USD, GBP/USD, and BTC

✅ Compounding strategies that build wealth steadily

✅ Transparency with real-time performance tracking

🏆 Bitcoin vs Traditional Assets (Last 10 Years)

Let’s simplify the comparison 👇

🔸 Stocks (S&P 500)

- Average annual return: ~10–12%

- Stable, but slow wealth creation

🔸 Gold

- Store of value

- Limited upside

- Mostly inflation protection

🔸 Real Estate

- Capital intensive

- Low liquidity

- Region-specific returns

🔸 Bitcoin

- Limited supply (21 million only) 🪙

- High liquidity

- Borderless

- Technology-driven

👉 This is why Bitcoin investment performance has clearly outshined every traditional asset.

📢 Final Thoughts

Bitcoin has already proven itself as the best-performing asset of the decade, beating tech giants and gold alike. The next big question is: What’s coming in the next 10 years?

With StealthX trading solutions, you can ride this wave with discipline, automation, and confidence.

🚀 Start with as little as $3,000 capital and aim for steady compounding returns.

🔗 Join Our Telegram Channel for daily updates & signals.